In the past, creditors and lenders took credit decisions, based on only the data that was available to them, on their customers when extending loans or giving credit facilities. Over the last ten years, with the services of Credit Bureaus, lenders and creditors can minimize their credit risk with the data that is shared with them before making lending decisions.

This is due to the fact that Credit Bureaus warehouse information on credit dealings from all sectors of the Nigerian economy. One of the tools used by Credit Bureaus, to provide information on the level of riskiness of individual consumers are credit scores.

Credit scores are the grades that credit reporting agencies or Credit Bureaus rate you with and share with creditors and lenders, who in addition with all other required documentation evaluate and decide who to extend their credit services to.

As a borrower, your credit score (a three-digit number) is an important factor in your financial life. A credit score is a number that shows how risky it is for a lender or creditor to do business with you. Credit scores range from 300 (lowest) to 850 (the highest).

The higher the score, the more likely you are to qualify for loans, credit cards or credit facilities at the most favorable terms which will save you a lot of money in interest rates. A higher score increases a lender or creditors confidence that you will make payments on time because you are a low risk customer. On the other hand, a lower credit score, can make it harder for you to get a loan and your interest rates could be higher because you are a perceived as a risky person to do business with.

So, building and maintaining a good credit score, is very crucial and these are a few ways to get a high credit score in 2019 and keep it that way:

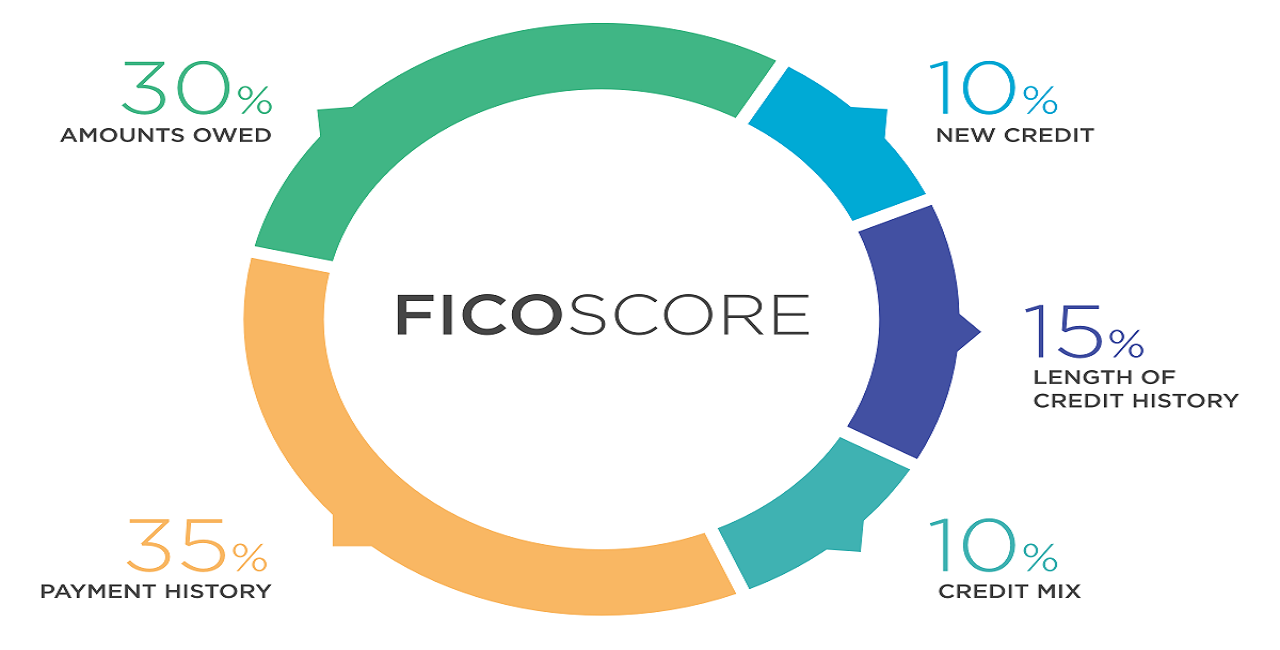

Know what it takes to get a good credit score: Knowledge is power and more so when it comes to understanding the science of maintaining a good credit score. The five key elements that are used to calculate your credit score as follows; payment history (35%), amount owed (30%), length of credit history (15%), new credit (10%) and the type of credit used (10%). So, knowing what affects your credit score is key in building and maintaining the high credit score that you desire.

Pay your bills on time: Payment history is one of the best ways to improve your credit score and is one of the primary categories used in calculating your credit score. As stated above, your payment history makes up 35% of your credit score. Therefore, paying your bills on time is one of the important steps to take, in raising and maintaining your credit score. Paying your bills shows lenders and creditors that you are financially disciplined and therefore a low risk.

Manage your Debt: Loan balances and lines of credit impact your level of debt. Having too much debt can cost you points on your credit score. The lower your debt, the easier it will be to maintain a good credit score. The amount of debt you have makes up 30% of your credit score. Carrying a lot of debt, especially high credit debt affects your credit score and your ability to get approved for new credit or loans. When your debt is too high, it makes lenders and creditors question if you will have the capacity to pay back on time.

Monitor your credit regularly: Your credit score is a representation of your credit status via a 3-digit number while your credit report is an account of your borrowing and repayment history across all sectors of the Nigerian economy. The information used to calculate your credit score comes from your credit report.

So, it is necessary to know and monitor exactly what creditors are seeing in your credit report, so you can take the necessary steps to improve it when necessary. Making sure your information is up to date and accurate is vital. To request for your credit report, please visit https://www.crccreditbureau.com/product/crc-self-enquiry

There are many benefits to having a good credit score and doing the above listed is the one of the many ways to ensure that your credit score stays healthy all year round and beyond.